Enterprise risk management tools aren’t just software; they’re your company’s safety net. They’re the unsung heroes preventing costly mistakes and ensuring smooth sailing, even in stormy business waters. This deep dive explores the world of ERM tools – from cloud-based solutions to on-premise giants, revealing how they can transform your risk management strategy from reactive to proactive.

We’ll dissect the key features that separate the champions from the also-rans, explore implementation best practices, and even peek into the future of ERM technology. Get ready to navigate the complex world of risk management with confidence and clarity.

Defining Enterprise Risk Management (ERM) Tools

Source: themindstudios.com

Enterprise Risk Management (ERM) isn’t just about avoiding trouble; it’s about strategically navigating uncertainty to achieve your business goals. Think of it as a sophisticated GPS for your entire organization, guiding you through potential pitfalls and maximizing opportunities. And just like a good GPS needs reliable tools, effective ERM relies on a robust suite of resources to function properly. These tools are crucial for identifying, assessing, responding to, and monitoring risks across the entire enterprise.

ERM tools provide a structured approach to risk management, moving beyond simple checklists to offer comprehensive solutions for complex organizational challenges. They offer a centralized platform for managing risk information, facilitating collaboration across departments, and enabling more informed decision-making. This allows businesses to proactively identify and mitigate risks, ultimately leading to improved resilience and stronger financial performance.

Core Functionalities of Enterprise Risk Management Tools

Effective ERM tools typically incorporate several key functionalities. These include risk identification and assessment, using various methodologies to pinpoint potential threats and evaluate their likelihood and impact. They also facilitate risk response planning, helping organizations develop strategies to mitigate, transfer, accept, or avoid identified risks. Furthermore, robust reporting and monitoring capabilities are essential, allowing for the tracking of risk profiles over time and providing valuable insights for strategic decision-making. Finally, many tools incorporate strong communication features to ensure all stakeholders are informed and aligned on risk management strategies.

Categories of ERM Tools

ERM tools encompass a wide range of resources, each playing a crucial role in the overall risk management process. Software solutions, for instance, offer centralized platforms for managing risk data, automating tasks, and facilitating collaboration. Examples include dedicated ERM software packages like Archer, MetricStream, and SAP GRC. These are often equipped with advanced analytics capabilities, allowing for sophisticated risk modeling and scenario planning.

Beyond software, ERM methodologies provide structured frameworks for approaching risk management. COSO (Committee of Sponsoring Organizations of the Treadway Commission) is a widely recognized framework that provides a comprehensive model for ERM. Similarly, ISO 31000 offers an internationally recognized standard for risk management principles and practices. These methodologies offer guidance on best practices and help organizations develop a consistent and effective risk management approach. Finally, frameworks such as those provided by regulatory bodies (like the Sarbanes-Oxley Act in the US) provide specific requirements and guidelines for organizations in regulated industries.

Key Features Differentiating Effective ERM Tools

The effectiveness of an ERM tool hinges on several key features. Effective tools are intuitive and user-friendly, ensuring seamless integration into existing workflows and minimizing the learning curve for users across different departments. They should also offer robust data management capabilities, allowing for efficient storage, retrieval, and analysis of risk-related information. Furthermore, strong integration with other enterprise systems is crucial, ensuring a holistic view of risk across the organization. Finally, the ability to customize the tool to meet the specific needs and context of the organization is paramount. Tools that lack flexibility may not effectively address the unique challenges faced by different businesses. For example, a small startup will have different needs compared to a large multinational corporation, highlighting the importance of customization options.

Types of Enterprise Risk Management Tools

Choosing the right Enterprise Risk Management (ERM) tool is crucial for any organization aiming to proactively identify, assess, and mitigate potential risks. The market offers a variety of options, each with its own strengths and weaknesses. Understanding these differences is key to making an informed decision that aligns with your specific needs and resources. This section dives into the different types of ERM tools based on their deployment method.

ERM Tool Deployment: Cloud-Based, On-Premise, and Hybrid

The way an ERM tool is deployed significantly impacts its accessibility, cost, and security. The three main deployment models are cloud-based, on-premise, and hybrid. Each offers a unique set of advantages and disadvantages, catering to different organizational structures and risk profiles.

| Deployment Type | Advantages | Disadvantages | Examples |

|---|---|---|---|

| Cloud-Based | Increased accessibility, scalability, cost-effectiveness (reduced IT infrastructure needs), automatic updates, and easier collaboration. | Dependence on internet connectivity, potential security concerns related to data breaches, vendor lock-in, and limited customization options. | LogicManager, Archer, MetricStream |

| On-Premise | Greater control over data security and customization, no reliance on internet connectivity, and potentially better integration with existing systems. | Higher initial investment costs (hardware, software, and IT infrastructure), ongoing maintenance and support expenses, limited scalability, and slower updates. | Some legacy ERM systems, custom-built solutions |

| Hybrid | Combines the benefits of both cloud-based and on-premise solutions, offering flexibility and scalability while maintaining control over sensitive data. | Increased complexity in management, potential integration challenges, and higher costs compared to purely cloud-based or on-premise solutions. | Solutions integrating cloud-based modules for specific functions with on-premise systems for sensitive data. |

Risk Management Focus by ERM Tool Type, Enterprise risk management tools

The specific risks addressed by each ERM tool type aren’t fundamentally different, but the *approach* to managing those risks varies. For instance, a cloud-based system might excel at managing risks related to operational efficiency and scalability, while an on-premise system could better handle risks related to highly sensitive data requiring stringent security controls.

Cloud-based tools often shine in managing risks associated with data accessibility and collaboration across geographically dispersed teams. Their scalability allows organizations to quickly adapt to changing risk landscapes, particularly in rapidly growing companies. However, reliance on a third-party vendor introduces risks related to vendor lock-in and potential data breaches if security protocols aren’t robust.

On-premise systems provide greater control over data security and compliance, making them ideal for organizations handling highly sensitive information, like financial institutions or government agencies. However, they demand significant upfront investment and ongoing maintenance, potentially limiting their adaptability to rapid changes in the risk environment. The risks here are often centered around the cost and complexity of maintaining the system.

Hybrid approaches offer a balance, allowing organizations to leverage the benefits of both models. For example, a company might store highly sensitive financial data on-premise while using a cloud-based platform for less critical risk data, striking a balance between control and cost-effectiveness. The risks here are largely focused on the successful integration and management of the two systems.

Key Features of Effective ERM Tools: Enterprise Risk Management Tools

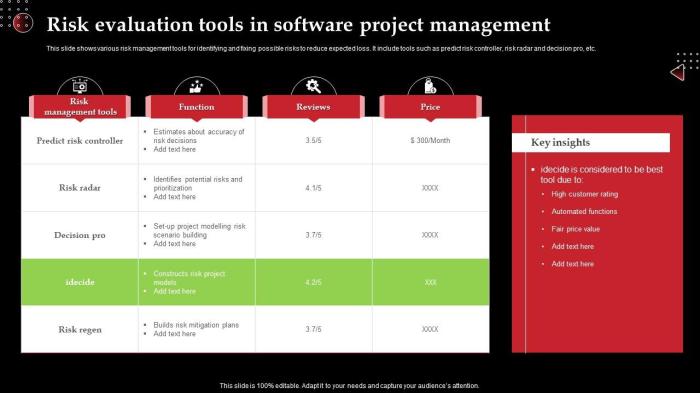

Source: slideteam.net

Choosing the right Enterprise Risk Management (ERM) tool can be a game-changer for your organization. A robust system isn’t just about ticking boxes; it’s about building a resilient, future-proof business. The right tool empowers you to proactively identify, assess, and mitigate risks, ultimately boosting your bottom line and safeguarding your reputation. This section dives into the essential features that define an effective ERM solution.

Effective ERM tools go beyond simple risk registers. They provide a holistic view of risk across the entire organization, enabling better decision-making and improved risk management practices.

Essential Features of a Robust ERM System

Several key features contribute to the effectiveness of an ERM tool. These features work together to provide a comprehensive and user-friendly platform for managing risk across all levels of the organization. Without these elements, the system’s value diminishes significantly.

- Centralized Risk Repository: A single, easily accessible database for all risk-related information, eliminating data silos and ensuring consistency.

- Risk Identification and Assessment Capabilities: Tools and methodologies for identifying potential risks, analyzing their likelihood and impact, and prioritizing them based on their severity.

- Risk Response Planning and Monitoring: Features that allow users to develop and implement risk mitigation strategies, track their effectiveness, and adjust plans as needed.

- Reporting and Analytics: Comprehensive dashboards and reports providing real-time insights into the organization’s risk profile, allowing for proactive management and informed decision-making. This includes the ability to generate custom reports tailored to specific stakeholder needs.

- Workflow and Collaboration Tools: Streamlined processes for assigning tasks, tracking progress, and facilitating communication among stakeholders involved in risk management.

- Audit Trails and Compliance Features: Comprehensive logging of all activities within the system, ensuring transparency and facilitating compliance with relevant regulations.

- Scalability and Flexibility: The ability to adapt to the changing needs of the organization as it grows and evolves, accommodating increased data volumes and more complex risk profiles.

Integration Capabilities with Other Business Systems

The true power of an ERM tool is unlocked through seamless integration with other business systems. This integration eliminates data duplication, streamlines workflows, and provides a more holistic view of the organization’s operational landscape. Isolated ERM systems are less effective.

For example, integrating the ERM tool with a company’s financial system allows for real-time analysis of the financial impact of risks. Integration with project management software allows for risk assessment to be incorporated directly into project planning and execution. Similarly, linking with HR systems enables identification of risks related to human capital. These integrations provide a more comprehensive and dynamic risk management process.

Hypothetical ERM Tool: User Interface and Reporting Capabilities

Imagine an ERM tool with a clean, intuitive interface. The dashboard displays key risk indicators (KRIs) using interactive charts and graphs, providing a quick overview of the organization’s overall risk profile. Users can drill down into specific risks to view detailed information, including risk assessments, mitigation plans, and related documents. The system uses a color-coded system (green, yellow, red) to instantly communicate risk severity levels. This visual approach makes it easy to understand the current state of risk management at a glance.

Reporting capabilities are highly customizable. Users can generate reports on specific risks, risk categories, or departments. The system allows for the creation of custom reports tailored to the needs of different stakeholders, from senior management to individual risk owners. Reports can be exported in various formats (PDF, Excel, CSV) for easy sharing and distribution. Automated reporting features ensure that regular reports are generated and distributed automatically, ensuring timely insights.

Implementing and Managing ERM Tools

Successfully implementing an Enterprise Risk Management (ERM) tool isn’t just about buying software; it’s about transforming how your organization identifies, assesses, and responds to risk. A smooth transition requires careful planning, robust training, and ongoing commitment from all levels of the company. Think of it as a marathon, not a sprint.

Successful ERM tool implementation hinges on a well-defined strategy and a phased approach. Ignoring crucial steps can lead to underutilization, resistance from employees, and ultimately, a failure to achieve the desired risk management improvements. This section details the best practices and a step-by-step guide to ensure a successful integration.

Best Practices for Successful ERM Tool Implementation

Effective ERM tool implementation isn’t a one-size-fits-all solution. It requires tailoring the process to your organization’s specific needs and culture. Key to success is clear communication, thorough training, and consistent monitoring. Consider these best practices to navigate the process effectively.

- Secure Executive Sponsorship: High-level buy-in is crucial for resource allocation and overcoming resistance to change. A champion at the executive level can ensure the project remains a priority.

- Define Clear Objectives and Scope: Establish specific, measurable, achievable, relevant, and time-bound (SMART) goals for the ERM tool implementation. This clarifies expectations and helps track progress.

- Choose the Right Tool: Select a tool that aligns with your organization’s size, complexity, and specific risk management needs. Consider scalability, integration capabilities, and user-friendliness.

- Develop a Comprehensive Implementation Plan: This plan should Artikel timelines, responsibilities, and resources needed. It should also include a risk assessment for the implementation process itself.

- Provide Thorough Training: Invest in comprehensive training for all users to ensure they understand the tool’s functionalities and how to use it effectively. Ongoing support and refresher training are also essential.

- Integrate with Existing Systems: Seamless integration with existing systems minimizes disruption and maximizes efficiency. Data migration should be carefully planned and executed.

- Establish Key Performance Indicators (KPIs): Define KPIs to measure the effectiveness of the ERM tool and track progress towards achieving your objectives. This allows for continuous improvement.

- Foster a Culture of Risk Awareness: ERM tools are only as effective as the organization’s commitment to risk management. Promote a culture where risk identification and mitigation are prioritized.

Step-by-Step Guide for Integrating an ERM Tool

Integrating an ERM tool requires a systematic approach. A phased rollout minimizes disruption and allows for iterative improvements. Consider this step-by-step guide as a roadmap for your implementation.

- Assessment and Planning: Analyze your current risk management processes, identify gaps, and define requirements for the new tool. This phase includes selecting the right vendor and tool.

- Data Migration and Cleansing: Migrate existing risk data into the new system. This often involves data cleansing and standardization to ensure data quality and accuracy.

- System Configuration and Customization: Configure the ERM tool to meet your organization’s specific needs and workflows. This may involve customizing reports, dashboards, and workflows.

- User Training and Adoption: Provide comprehensive training to all users. This includes hands-on training, documentation, and ongoing support. Address any resistance to change proactively.

- Pilot Program and Testing: Conduct a pilot program with a smaller group of users to test the tool’s functionality and identify any issues before a full rollout.

- Full Deployment and Monitoring: Deploy the ERM tool across the organization and monitor its performance. Continuously evaluate its effectiveness and make adjustments as needed.

- Ongoing Maintenance and Support: Regularly update the tool, provide ongoing support to users, and conduct periodic reviews to ensure its continued effectiveness.

Resource and Training Plan for Effective ERM Tool Usage

A successful ERM tool implementation requires a dedicated resource allocation plan. This includes financial resources, personnel, and training programs. Ignoring this aspect can lead to implementation failures.

Consider allocating resources for the following:

- Project Management Team: A dedicated team to oversee the implementation process, manage timelines, and address challenges.

- IT Support: Technical expertise for system integration, data migration, and ongoing maintenance.

- Training Resources: Invest in training materials, instructors, and ongoing support for users. This could include online modules, workshops, and on-the-job training.

- Data Migration and Cleansing: Allocate resources for data migration, cleansing, and validation to ensure data quality.

- Ongoing Maintenance and Updates: Budget for software updates, maintenance, and ongoing support from the vendor.

- Change Management Support: Resources to manage the change process and address employee resistance.

ERM Tools and Compliance

Enterprise Risk Management (ERM) tools aren’t just about identifying and mitigating risks; they’re crucial for demonstrating compliance with a growing array of regulations. In today’s complex business environment, proving adherence to legal and financial standards is paramount, and ERM tools offer a powerful solution for streamlining this process and minimizing potential penalties. They provide a centralized system for tracking, monitoring, and reporting on risk management activities, making compliance audits significantly easier and more efficient.

ERM tools play a vital role in mitigating both legal and financial risks. By providing a structured framework for identifying, assessing, and responding to risks, organizations can proactively address potential compliance breaches before they occur. This proactive approach not only reduces the likelihood of legal repercussions but also safeguards the organization’s financial stability. Effective risk management minimizes disruptions, protects assets, and fosters investor confidence.

ERM Tools and Regulatory Compliance

Meeting regulatory compliance requirements often involves demonstrating adherence to numerous industry-specific rules and regulations. For example, financial institutions must comply with regulations like Dodd-Frank, while healthcare providers navigate HIPAA. ERM tools facilitate this by providing a systematic way to track compliance obligations, assign responsibilities, and monitor progress towards meeting those obligations. The tools’ ability to document risk assessments, control implementations, and remediation efforts creates an auditable trail, providing evidence of compliance during inspections. Imagine a scenario where a bank uses an ERM tool to track its compliance with Know Your Customer (KYC) regulations. The tool would allow the bank to monitor customer due diligence processes, record all related activities, and generate reports to demonstrate adherence to the regulations. This level of documentation significantly simplifies compliance audits and minimizes the risk of penalties.

Mitigating Legal and Financial Risks with ERM Tools

The strategic use of ERM tools directly impacts an organization’s legal and financial health. By providing a comprehensive view of potential risks, these tools empower organizations to make informed decisions that minimize exposure to both legal challenges and financial losses. For example, an ERM tool might identify a potential legal risk associated with a new product launch, prompting a thorough review of relevant regulations and adjustments to the product’s design or marketing strategy. Similarly, an ERM tool could reveal financial risks associated with supply chain disruptions, allowing the organization to implement mitigation strategies such as diversifying its suppliers or securing alternative supply routes. This proactive approach to risk management protects the organization’s reputation, minimizes potential litigation, and safeguards its financial resources.

Reporting Features for Demonstrating Compliance

The reporting capabilities of an effective ERM tool are essential for demonstrating compliance. These reports provide clear evidence of the organization’s risk management efforts and its adherence to relevant regulations. Comprehensive reports are critical during audits and demonstrate a commitment to proactive risk management.

- Risk Register Reports: These reports provide a detailed overview of all identified risks, including their likelihood, impact, and assigned owners. They show the organization’s understanding of its risk landscape and its efforts to manage those risks.

- Control Effectiveness Reports: These reports demonstrate the effectiveness of implemented controls in mitigating identified risks. They typically include metrics on control testing frequency, results, and any identified gaps.

- Compliance Status Reports: These reports track progress towards meeting specific regulatory requirements. They clearly show which regulations are being addressed, the status of compliance for each requirement, and any outstanding actions.

- Audit Trail Reports: These reports document all changes made to the ERM system, including risk assessments, control implementations, and remediation activities. This audit trail provides an immutable record of the organization’s risk management activities.

- Exception Reports: These reports highlight any deviations from established risk management policies or regulatory requirements. They allow for timely intervention and corrective actions.

Cost and Benefits of ERM Tools

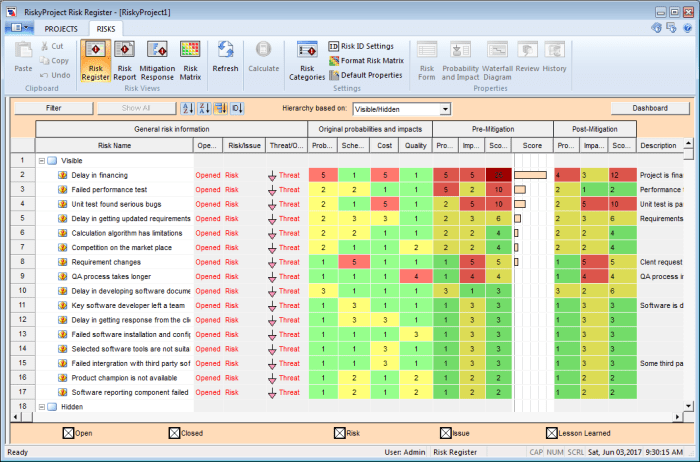

Source: intaver.com

Implementing an Enterprise Risk Management (ERM) tool is a significant investment, but the potential returns can far outweigh the initial costs. A thorough cost-benefit analysis is crucial to justify the expenditure and ensure alignment with organizational goals. This section delves into the financial aspects of ERM tool implementation, comparing costs and highlighting the tangible and intangible benefits.

Understanding the true cost of an ERM tool requires a holistic approach, moving beyond the initial purchase price to encompass all associated expenses. This includes software licensing, implementation services, training, ongoing maintenance, and potential upgrades. Conversely, the benefits extend beyond quantifiable financial gains, encompassing improved decision-making, enhanced risk awareness, and stronger regulatory compliance.

Cost-Benefit Analysis Template for ERM Tools

A robust cost-benefit analysis requires a structured approach. The following template helps organizations systematically evaluate different ERM tools:

| Cost Category | Description | Estimated Cost |

|---|---|---|

| Software License | Annual or perpetual license fees for the chosen ERM software. | $X (Variable, depends on vendor and features) |

| Implementation Services | Costs associated with configuring, customizing, and deploying the ERM tool. Includes consultant fees and internal staff time. | $Y (Variable, depends on complexity and scope) |

| Training | Costs for training employees on using the ERM tool effectively. | $Z (Variable, depends on the number of users and training methods) |

| Maintenance and Support | Ongoing costs for technical support, software updates, and maintenance. | $W (Variable, typically a percentage of the license fee) |

| Hardware and Infrastructure | If necessary, costs associated with purchasing or upgrading hardware and IT infrastructure to support the ERM tool. | $V (Variable, depends on existing infrastructure) |

| Total Cost of Ownership (TCO) | Sum of all cost categories over a defined period (e.g., 3-5 years). | $X + $Y + $Z + $W + $V |

The benefit side should quantify avoided losses (e.g., reduced fines from non-compliance, prevented financial losses from identified risks), improved efficiency (e.g., time saved in risk assessment processes), and enhanced decision-making (e.g., improved strategic planning due to better risk insights).

Total Cost of Ownership (TCO) Comparison for Various ERM Solutions

Comparing TCO across different ERM solutions requires careful consideration of the features, scalability, and support offered by each vendor. For example, a cloud-based solution might have lower upfront costs but higher recurring subscription fees compared to an on-premise solution. A smaller company might opt for a simpler, less expensive tool with fewer features, while a larger enterprise might require a more comprehensive and potentially costly system. Detailed pricing information is usually available from vendors upon request, allowing for a direct comparison based on specific organizational needs.

Intangible Benefits of Implementing an ERM Tool

Beyond the quantifiable financial benefits, ERM tools offer significant intangible advantages. Improved decision-making stems from a more holistic understanding of risk, enabling proactive mitigation strategies. Enhanced risk awareness fosters a more risk-conscious culture, empowering employees at all levels to identify and report potential issues. These intangible benefits contribute to a more resilient and successful organization, ultimately increasing long-term value. For instance, a company that successfully mitigates a major risk through early identification avoids potential reputational damage and loss of customer trust, benefits that are difficult to quantify directly but significantly impact the organization’s overall success.

Future Trends in Enterprise Risk Management Tools

The world of risk management is evolving at a breakneck pace, driven by increasingly complex global landscapes and the relentless march of technology. ERM tools are no exception; they’re becoming smarter, more integrated, and more predictive, offering businesses a crucial edge in navigating uncertainty. The future of ERM tools is bright, promising a more proactive, data-driven approach to risk mitigation.

This evolution is largely fueled by advancements in artificial intelligence (AI) and machine learning (ML). These technologies are transforming how organizations identify, assess, and respond to risks, moving beyond reactive measures to a more anticipatory posture. The potential impact on risk management practices is profound, promising greater efficiency, accuracy, and strategic insight.

AI and Machine Learning Integration in ERM

The integration of AI and ML is revolutionizing various aspects of ERM. AI-powered systems can analyze vast datasets – encompassing financial reports, market trends, news articles, social media sentiment, and internal operational data – to identify emerging risks far earlier than traditional methods. Machine learning algorithms can identify patterns and anomalies that might indicate potential threats, enabling proactive interventions. For example, an AI-powered system might detect a sudden increase in negative social media sentiment surrounding a company’s product, flagging a potential reputational risk before it escalates into a full-blown crisis. This predictive capability is a game-changer, allowing organizations to allocate resources more effectively and mitigate risks before they materialize. Furthermore, ML algorithms can continuously learn and improve their risk identification accuracy over time, adapting to changing business environments and emerging threats.

Features of a Next-Generation ERM Tool

Imagine an ERM tool that goes beyond simple risk identification and quantification. A next-generation ERM tool would seamlessly integrate various data sources, leveraging AI and ML to provide real-time risk assessments and predictive analytics. It would not only identify potential risks but also suggest mitigation strategies based on historical data and best practices. This tool would feature a user-friendly interface, allowing even non-technical users to understand and interact with the system effectively. Furthermore, it would offer robust reporting and visualization capabilities, providing stakeholders with clear and concise insights into the organization’s risk profile. Consider a scenario where such a tool automatically identifies a potential supply chain disruption based on geopolitical instability and then suggests alternative suppliers, complete with cost-benefit analysis. This level of automation and predictive power would transform how organizations manage risk, allowing for more strategic decision-making and enhanced resilience.

Case Studies of ERM Tool Implementation

Real-world examples offer invaluable insights into the effectiveness and challenges of implementing Enterprise Risk Management (ERM) tools. Examining both successful and unsuccessful deployments reveals crucial lessons for organizations considering similar initiatives. These case studies highlight the importance of careful planning, stakeholder engagement, and continuous improvement in building a robust ERM framework.

Successful ERM Tool Implementation: A Case Study of a Global Financial Institution

A major global financial institution, facing increasing regulatory scrutiny and a complex risk landscape, implemented a comprehensive ERM tool. The project involved a phased approach, starting with a thorough risk assessment and the selection of a software solution that integrated seamlessly with existing systems. Key challenges included data migration from disparate sources, user training, and achieving buy-in from diverse business units. The institution addressed these by establishing a dedicated project team, providing extensive training programs, and demonstrating the tool’s value through early wins, such as improved reporting and faster identification of emerging risks. The successful implementation led to a more proactive risk management approach, improved regulatory compliance, and a significant reduction in operational losses. Crucially, the institution emphasized ongoing monitoring and refinement of the system, adapting it to changing business needs and regulatory requirements. This continuous improvement process proved vital to the long-term success of the ERM initiative.

Negative Consequences of Inadequate Risk Management: A Case Study of a Retail Chain

A large retail chain failed to adequately address the risks associated with supply chain disruptions. Lacking a robust ERM system, the company relied on informal processes and lacked a centralized view of its vulnerabilities. When a major supplier faced unexpected production issues, the retail chain experienced significant stock shortages, leading to lost sales, damaged brand reputation, and ultimately, a decline in profitability. This situation highlights the severe financial and reputational consequences of neglecting comprehensive risk management. The absence of an ERM tool prevented early identification and mitigation of the supply chain risk, amplifying the negative impact of the disruption. The company’s reactive approach, rather than a proactive one enabled by an ERM tool, exacerbated the crisis.

Hypothetical Scenario: Preventing a Business Crisis with an ERM Tool

Imagine a rapidly growing tech startup experiencing a sudden surge in customer demand. Without a robust ERM system, the company might struggle to manage the increased operational load, leading to system failures, customer dissatisfaction, and reputational damage. However, if the company had implemented an ERM tool, it could have proactively identified the potential risks associated with rapid growth, including IT infrastructure limitations, customer service capacity constraints, and security vulnerabilities. The ERM tool would have enabled the company to develop contingency plans, allocate resources effectively, and mitigate these risks before they escalated into a major crisis. For example, the tool could have flagged the need for increased server capacity, additional customer support staff, and enhanced security measures, preventing a service outage or data breach. This proactive approach, facilitated by the ERM tool, would have ensured business continuity and protected the company’s reputation and profitability.

Conclusion

Ultimately, effective enterprise risk management tools are more than just a technological solution; they’re a strategic investment in your company’s future. By understanding the different types of tools available, their key features, and how to successfully implement them, businesses can significantly reduce their exposure to risk and unlock opportunities for growth. Don’t just react to risk – anticipate it, manage it, and conquer it.